-

Beginning January 1, 2024, new member ID cards were issued as members moved to the new platform.

-

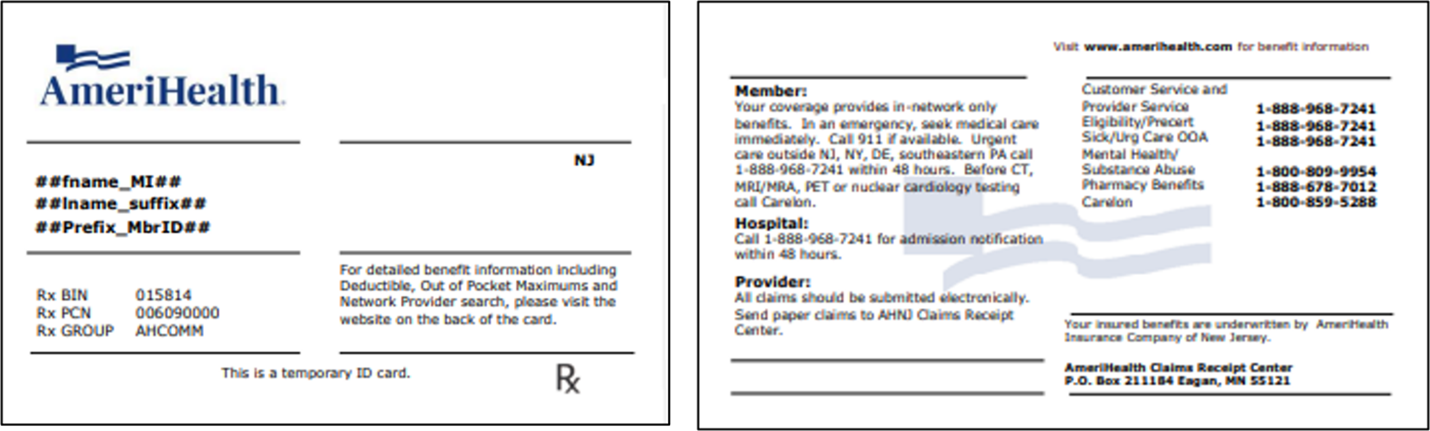

Starting July 1, 2024, additional membership was transitioned to the new platform upon the member’s renewal date. This continues to be a rolling transition, with new members moving each month. Some members may receive a paper letter, temporary ID card, or digital ID card with a new member ID number. Temporary ID cards contain the critical information members need to receive access to care, but not all information.

Please accept the paper letter, temporary ID card, or digital ID card for services that occur until the member’s new card arrives.

Sample temporary card:

-

Some products may have a new prefix. Updated Payer ID grids are available

here.

-

The new ID cards will have an eight-digit subscription ID and a ten-digit member ID. The member ID uses the eight-digit subscription ID as its base and a two-digit suffix to distinguish the subscriber from dependents.

-

Starting August 1, 2024, AmeriHealth commercial members with the New York (NY) Access or National Access network will receive a new ID card when their plan renews. In addition to the network indicator (e.g., Local Value and Regional Preferred) located on the top right of the card, the new ID cards may show one of these options, depending on the benefits purchased:

-

A Private Healthcare Systems, Inc. (PHCS) logo – for members with National Access

-

Both the PHCS logo and a "New York ONLY" indicator – for members with NY Access

Note: Some members may still have NY Access via GHI Emblem. Their card will display the GHI network access logo.

7. What happens if a claim is submitted with the wrong member ID number?

-

If you submit a claim with an old ID number after the new card is effective, the claim will be denied with this message:

“Member did not have eligible coverage.”

-

If this occurs, please obtain the new ID number from the member and submit a new claim. Please do not submit this type of claim as a corrected claim.

8. What if the member does not have their ID card at the time of service?

-

You can use the Eligibility & Benefits transaction on PEAR Practice Management (PM) to confirm the member's eligibility. To ensure you are viewing accurate information for the noted date of service, you must search for a member using their

name and

date of birth.

-

Temporary ID cards issued will not have the plan name, plan information like copayment amounts, deductibles, out-of-pocket maximums, or Primary Care Physician (PCP) information for members with HMO plans. However, you can access the member’s complete information when using the Eligibility & Benefits transaction to confirm eligibility and benefits.

-

You can also view an image of the member's ID card by selecting View Details.

9. How will the new member ID affect member search, referrals, authorizations, and billing?

-

As members are moved to the new platform, they will be issued a new member ID card. Note that new ID cards will be issued as members move in stages through 2025.

-

To search for a member, you should continue to use the Eligibility & Benefits transaction in PEAR PM. Search by the date of service along with the member’s name and date of birth to obtain the new member ID number.

-

Searching for an existing authorization:

- For members who have a new ID number (10-digit format), they may have an existing authorization that was submitted under their old ID number (12-digit UMI). Authorizations submitted under the member's old ID number remain valid. You do not need to enter a new authorization under the member’s new ID number.

- Use the

Authorization Search transaction and search by the member’s name and date of birth. You will also need to note the appropriate location.

- If an authorization needs to be

extended, a new authorization request should be submitted under the member's new ID number.

- If you are unable to locate an authorization that was submitted via eviCore or Carelon Medical Benefits Management (Carelon), please search for the authorization on the eviCore or Carelon portals using the member's old ID number. If there are additional questions, please work with eviCore or Carelon directly.

-

When searching for referrals using the referral number, you may see two results – one with the old member ID number and the other with the new member ID number. Referrals submitted under the members’ old ID number remain valid. You do not need to enter a new referral under the member’s new ID number.

-

For billing purposes, you should bill under the member ID that is active at the time of admission or the date of service.

Provider payment transition

10. Who is the new payment vendor?

-

AmeriHealth will transition from the vendor we currently use to issue medical claim payments to PNC Bank's Claim Payments & Remittances (CPR) service, powered by ECHO Health.

-

The transition will include medical claim payments, remittances, and capitation payments, including 835/electronic remittance advice (ERA) transactions and electronic funds transfer (EFT).

11. When will the transition occur?

-

Base capitation payments: All base capitation payments are being processed by CPR, which began in January 2024, for

all AmeriHealth members. Payment rosters will continue to be accessed via the Analytics & Reporting application on the PEAR portal.

Please note that we discontinued mailing capitation rosters as of January 1, 2024. Access to the PEAR portal is required to view your capitation roster.

-

Claim payments: As of January 2024, medical claim payments and remittances for New Jersey AmeriHealth Medicare members are being sent via CPR. Payments will continue to be processed by our current vendor until the member's plan is moved to the new platform. As a result, you may receive multiple payments within a given payment cycle (e.g., weekly).

12. What do providers need to do to prepare for the transition?

-

Existing account with CPR/ECHO. Some providers may already use CPR/ECHO for other health insurer payers. Additional information about your account, EFT, or 835/ERA updates was provided directly by ECHO Health in November 2023.

-

New to CPR/ECHO. If you were new to CPR/ECHO, you received additional communication in November 2023 with information from ECHO Health that outlines the options available to receive payments, including EFT, virtual credit card, electronic check, or paper check.

-

Important: If you are not paid via EFT or there is no payment preference selected, you will receive payment via a virtual credit card. Please note that normal transaction fees apply and are based on your merchant-acquirer relationship.

13. How do I make changes to my EFT information?

-

As of January 1, 2024, if you need to make a change to your EFT information, please continue to complete and submit the appropriate form on the EFT Resources page. In addition, please submit your EFT changes to PNC Healthcare via the EFT and ERA Enrollment Form to ensure your EFT transactions are appropriately handled for all of our vendor platforms.

14. Where can I view my payment information?

-

To view your Provider Explanation of Benefits, Provider Remittance, or Explanation of Provider Payment (EPP) – for claims processed on the new platform after January 1, 2024 – or paper check payments, you can continue to use the Practice Management (PM) application on the

PEAR portal. Select EOB & Remittance from the Transactions drop-down menu.

-

If you have any questions related to your 835/ERA files, please work directly with your Trading Partner.

15. Will there be changes to my payment statement?

-

The layout of the new EPP is slightly different than the existing Provider Explanation of Benefits (professional) and Provider Remittance (facility). View this

sample EPP to see a few new or different fields to help you get acclimated.

-

Both professional and facility providers will receive the EPP for claims processed on the new platform. There will no longer be separate versions based on the provider type.

-

You can view your EPP on ECHO Health's provider portal. There are several search options, including Provider ID, Claim Number, EFT Draft Number, and Payment Reference Number.

- You can also access your EPPs for recent claims processed on the new platform using the EOB & Remittance transaction in PEAR PM.

16. Where can I go if I have any questions about the transition?

-

For questions on updating your payment preference, please contact ECHO Health at 1-800-813-9861.

Billing/Claims submissions

17. Are the taxonomy billing requirements changing as part of the platform transition?

-

We will continue to require the use of taxonomy codes to ensure proper claims processing. This allows for the accurate application of specialty-driven policies and matching of the provider’s agreement(s) with AmeriHealth.

-

There are specific segments/fields that require a taxonomy code when submitting professional and institutional claims – paper and electronic. Review the requirements outlined

here.

-

Failure to submit claims with the applicable NPI and correct correlating taxonomy code will result in claim denials that must be corrected prior to payment consideration.

18. Do providers need to take any action related to taxonomy codes?

-

We encouraged your practice administrators to confirm the specialty we have on file before January 1, 2024, for the services rendered by your practice/organization. If questions remain related to your specialty, please contact us.

-

Your group's specialty and/or the specialty of the practitioners in your practice/organization is visible in PEAR PM. Please take the steps outlined here to locate and review your specialty and submit changes as necessary.

19. Will there be changes to the Payer ID grids?

-

Yes, the Payer ID grids will be reviewed and updated throughout the transition. View the current grids

here.

EDI Gateway transition

20. Who is the new EDI Gateway vendor?

- AmeriHealth and AmeriHealth Administrators have transitioned Electronic Data Interchange (EDI) transactions from our current EDI vendor to the Smart Data Solutions (SDS) Stream Clearinghouse.

21. When will the transition occur?

-

The transition to SDS, which started in November 2023, was done in phases through the end of the second quarter of 2024.

22. Which transactions were migrated to the SDS EDI Gateway?

-

The following EDI transactions were included in the transition:

| 837I |

Health Care Claim (Institutional) |

005010X223A2 |

|

837P |

Health Care Claim (Professional) |

005010X222A1 |

|

835 |

Health Care Claim Payment/Advice |

005010X221A1 |

|

999 |

Functional Acknowledgment |

005010X231A1 |

|

277CA* |

Health Care Claim Acknowledgment |

005010X214 |

|

270/271 |

Health Care Eligibility/Benefit Request and Response |

005010X279A1 |

*If you submit claims for the receiver ID TA720 or 54763, you currently receive a U277. You will receive 277CA acknowledgement transactions upon your transition to SDS.

23. How did Trading Partners prepare for the transition?

-

From August through October 2023, SDS connected with Trading Partners to get them ready for the transition:

-

Existing Trading Partners. For those Trading Partners who already had an established connection with SDS, they received direct outreach to begin the process.

-

New to SDS. Trading Partners that were new to working with SDS received a custom verification code from SDS to begin the registration process.

-

Trading Partners needed to have the following information ready once contacted by SDS:

- Provide contact information (name/phone/email) for someone SDS can work with who would receive testing results and data editing instructions.

-

Confirm the payer IDs used for routing.

- For 835/ERA registration: Review the tax ID numbers and NPIs for providers that needed to be enrolled with SDS and advise of changes.

- Provide sample test claims: Five Professional and five Institutional claims. These claims should not have included production data. They were used during testing to validate your connectivity with SDS and ensure compliance.

- The Trading Partner contact received additional outreach from SDS prior to their specific transition date.

-

Migration efforts began in November 2023.

24. If I currently receive 835s/ERAs through an EDI vendor, do I need to enroll with PNC Healthcare (our new payment vendor)?

- For Trading Partners who receive 835s/ERAs today, AmeriHealth will transfer your current EDI vendor information to PNC Healthcare. No new enrollments are required, and you will continue to receive 835/ERA files to your existing EDI vendor. See the Provider payment transition section to learn more.

25. How does the payment transition to PNC Healthcare affect the EDI vendor transition to SDS?

-

The EDI vendor component of our platform transition involves both SDS and PNC Healthcare.

- SDS will be the exclusive EDI gateway for submission of claims, eligibility inquiries, and claim status inquiries. However, the delivery of 835s/ERAs will be split over both vendors.

-

SDS is responsible for delivery of 835s/ERAs for claims that process on our current platform.

- PNC Healthcare is responsible for 835s/ERAs for claims as they process on the new platform.

- Once all membership has moved to the new platform and the current platform is de-commissioned, all 835s/ERAs will be delivered via PNC Healthcare. At that point, SDS will be the gateway only for inbound transactions (i.e., claims, eligibility inquiries, and claim status inquiries).

26. Where can I go if I have any questions about the transition?

-

Visit the new

SDS Trading Partner Information Center for an overview of the registration process and to review the Trading Partner Registration Guide. You will be notified by SDS when it is time to start the transition process.

-

If you have any questions, please contact the SDS support team Monday through Friday, 8 a.m. through 5 p.m. CT at

stream.support@sdata.us or 1-855-297-4436.

Authorization workflow changes

27. When will the authorization changes occur?

28. What kind of changes can we expect to the workflow?

-

The following PEAR PM transactions were affected: Authorization Submission and Authorization Search.

-

Examples of changes include:

-

How to search for an authorization

-

Change in authorization numbers

-

New on-screen messaging

-

Improved surveys

29. How can I learn more about the changes?

-

Review the updated

Authorization 101 user guide on the PEAR

Help Center.

-

In addition, training materials were sent to the affected PEAR Administrators prior to the release of each service type. These materials can be shared with anyone in the organization handling authorizations.

Please review our training sessions (under Training and Resources) for more information about this transition.